GUIDING YOU towards right opportunities

Feel WELCOME

Welcome to the Official Website of BNG Hotel Management Kolkata

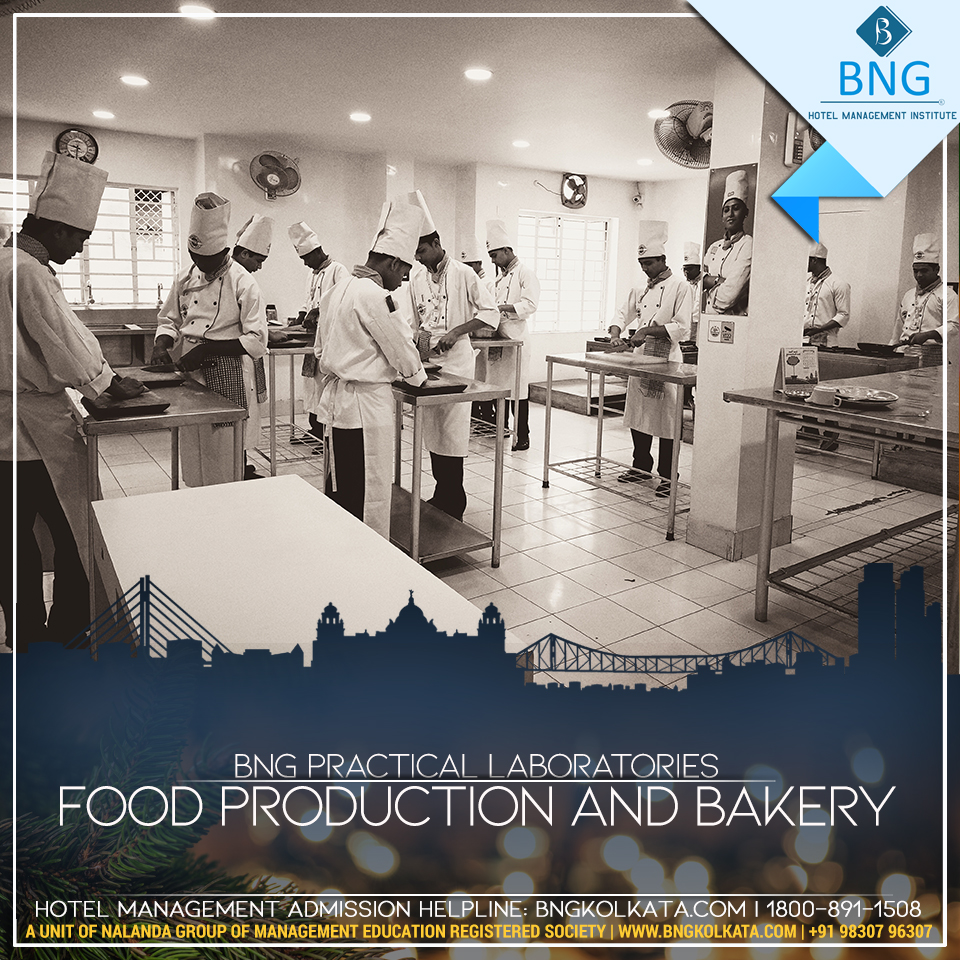

BNG Hotel Management Kolkata is among the finest hotel management institutes in India, The college and its courses have been designed to teach promising and talented younger girls and boys who want to take on the hospitality industry as a career. The whole gamut of hospitality and hotel operations is included in distinct fields under the equipped guidance of an educated and skilled group of faculty. BNG strives to provide need-established official training to a multitude of young and aspiring hoteliers… In simulated atmosphere close to real existence.

You are someone unique YOU SHARE OUR PASSION

Feel WELCOME

Featured Courses

Hotel management course from BNG Hotel Management College will provide you with qualitative theoretical, practical and on the job industrial training so that you’re able to take on the hospitality industry… .

Awards and Recognitions

BNG Hotel Management has continued its custom of being acknowledged and honored for its dedication to high quality and excellence.

Enjoy yourself DREAM BIG FOR YOUR FUTURE

Feel WELCOME

Hotel Management Blog

Hotel management, current trends, Salaries for different job profiles in the hotel industry, blog posts, discussion on various hotel management subjects and topics…

5 suggestions for boutique hotel owners

[ad_1] Unbiased hotels are flourishing all through the hospitality sector. Nevertheless, boutique hotels have tight…

Gin -Types & Brand

Gin: Ingredients, types and brand names. Gin is a flavored alcoholic beverage produced by re-distilling…

Housekeeping Supplies and Amenities

Housekeeping Supplies and Amenities Housekeeping supplies and amenities are the list of items that the…

Hotel Yield Management

Hotel Yield Management A technique based on supply and demand used to maximize revenues by…